Mon-Fri 9am-5pm

Talk to our friendly electric car leasing experts now: 01942 910 001This website uses cookies to ensure you get the best experience. Learn more

Electric Car Leasing and Commission - What Next after The Supreme Court Decision?

After The Supreme Court Decision - What Next for Electric Car Leasing Commission?

Friday 1 August 2025 was a key date for many involved in the motor finance industry. At this juncture, we are not just talking about the contract hire industry which e-car lease operates in; brokers, vehicle sourcing agents, dealerships, finance companies and banks throughout the UK were wondering what would happen moving forwards with historic practice on commission.

Whether your vehicle was new, or used, and procured via a loan, hire purchase, personal contract purchase, personal contract hire or any such financial tool, there were queries surrounding the practices, information, disclosure and awareness of commission being paid within these transactions.

The significance of the Supreme Court’s decision cannot be underestimated, which is why even the Government was looking to become more involved amidst fear of a mass tort and claims companies bringing various companies into disarray and potential insolvency. However, as highlighted at paragraph 56 of the Supreme Court decision:

“The court also received, but rejected, a request to intervene from HM Treasury. Although the draft submissions clearly expressed the apprehension within Government as to the national economic consequences of the Court of Appeal’s decision.”

Hearing three separate, but conjoined appeals, the Court was essentially investigating the lawfulness of commission paid by finance lenders to the motor dealers they operate with.

While recognising the “modest” sums of commission involved, the Court was aware of how widely used car finance has become and that non-disclosure, or partial disclosure, is very widespread. As such, any decision they made would be significant to the finance lenders and these sums at stake would very much be material.

Much of the cases being reviewed were focused on the fiduciary relationship which a dealership was purported to undertake for their customers when acting as a credit broker for the hire purchase agreement and, because the commission was deemed to be secret, whether or not these could be treated as bribes.

In one case, where the commission was disclosed, the customer because informed consent was not secured could this be considered a breach of the dealership’s fiduciary duty for an unauthorised profit with the lender being liable as the dishonest assistant.

As motor finance is so varied, many of the instances above involve used-car motor dealerships who are selling their own stock vehicles via their panel of lenders. Within the hire purchase industry, credit profiles, rates of interest and commissions are far more varied and complex than in our contract hire industry.

However, that is not to say that the leasing market is not without its complexities, with some finance companies operating a fixed commission approach for regulated customers (consumers) and non-regulated customers (businesses) whereas others operate a mix of either fixed or discretionary commission model. However, in most cases e-car lease as your credit broker is paid some form of commission and this will, in most cases, influence the monthly price you or the business pays for the vehicle.

While not an overtly interest-led finance product, this is still a consideration when considering the total amount payable. The big questions facing us all in the leasing community therefore was:

- Do leasing brokers owe their customers a fiduciary duty?; and

- What obligations do leasing brokers have to our customers with regards to commission or fees?

At paragraph 339 of their decision the Supreme Court was clear that the dealers in the aforementioned cases did NOT have a fiduciary duty to their customers. The claims against the lenders involved were therefore rejected, as equity and bribery does not exist without the fiduciary relationship.

However, in one of the cases, Mr Johnson and FirstRand, the Court did uphold his claim as the size of the commission, failure to disclose it and concealment of the ties between the dealer and FirstRand were not acknowledged. Breathing a sigh of relief, finance companies, banks and lenders will therefore not be held to account in the way many thought after the Court of Appeal’s initial decision on this controversial subject.

So what next?

The process is not yet over, as the UK’s financial regulator - the FCA - must now respond to the Supreme Court motor finance judgment. As can be found on the FCA website the FCA are taking the time to digest and review the decision and will be bringing greater clarity for consumers, firms and investors on Monday 4 August. The FCA will confirm whether they will (or not) consult on a redress scheme before any markets open. However, the FCA do say:

'"Our aims remain to ensure that consumers are fairly compensated and that the motor finance market works well, given around 2 million people rely on it every year to buy a car.”

Much of what happens next is very much reliant on how the FCA decide to handle the decisions and what aspects of the motor finance industry they decide to report on. While media and news outlets have reported on the consumer disappointment on the decision, which will effectively prevent many from pursuing any claims, the FCA do still have the discretion and power to authorise a limited compensation scheme for consumers.

Who is eligible and the extent of the compensation are again unknown but with many consumers aligning with claims management firms, they do need to be aware that any successful claim will be deducted in accordance with their fees.

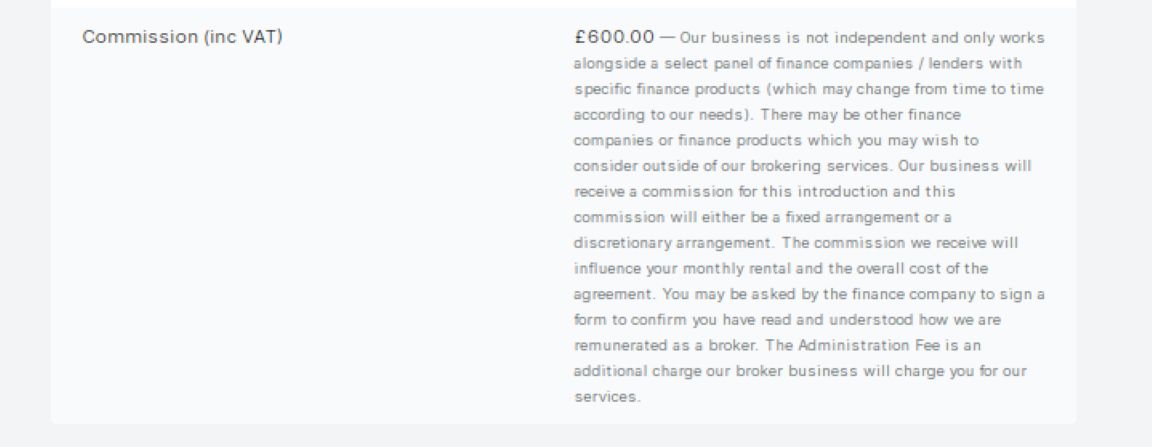

In the contract hire industry commission has become a key focus for many banks, lenders, brokers and the BVRLA (ombudsman). While every broker will manage their transaction slightly differently, the notion of commission should be something which is clearly highlighted in any documentation for a regulated customer. At e-car lease, our customer portal - Lythium- has been providing a clear commission statement since 2022. For every customer, regulated or non-regulated, we show:

- The amount of commission - including or excluding VAT

- A statement on commission - Our business is not independent and only works alongside a select panel of finance companies / lenders with specific finance products (which may change from time to time according to our needs). There may be other finance companies or finance products which you may wish to consider outside of our brokering services. Our business will receive a commission for this introduction and this commission will either be a fixed arrangement or a discretionary arrangement. The commission we receive will influence your monthly rental and the overall cost of the agreement. You may be asked by the finance company to sign a form to confirm you have read and understood how we are remunerated as a broker. The Administration Fee is an additional charge our broker business will charge you for our services.

Example

Moving forwards we will continue with this high-standard approach, as part of building customer confidence and demonstrating our clear focus on clear process.

e-car lease work alongside these select finance companies:

e-car lease have a partnership and affiliation with:

Register & get new deals weekly

Exclusive offers

Exclusive offers

Electric-only deals

Electric-only deals

Never miss out

Never miss out

Talk to one of our experts

01942 910 001 Email usLeasing

© Copyright 2025 e-car lease. All rights reserved. e-car lease is a trading name of CarLease (UK) Ltd, e-car lease is a credit broker and not a lender. We are authorised and regulated by the Financial Conduct Authority. Registered No: 706617. BVRLA Membership No. 1471. Registered in England & Wales with Company Number: 09312506 | Data Protection No: ZA088399 | VAT No: 200422089 | Registered Office: Kings Business Centre, Warrington Road, Leigh, Greater Manchester, WN7 3XG

Made by morphsites®