Mon-Fri 9am-5pm

Talk to our friendly electric car leasing experts now: 01942 910 001This website uses cookies to ensure you get the best experience. Learn more

Electric Company Car Tax explained

An explanation of electric company car tax

The “Electric Power Unleashed” 3008 model from Peugeot, represents yet another new EV making its way to the UK in 2024. With the Government continuing to push electrification of our fleet - cars, vans and beyond - there is now an onus on the various manufacturers to ensure there are a litany of options to lease.

And while the upcoming ZEV Mandate Consultation will come into force as at January 2024, which effectively enforces brands to sell a certain percentage of all-electric vehicles within their product suite, there are some proactive measures which are also being utilised. For example, in October 2023 the Government announced new laws to make charging EVs easier with access to more transparent information, price comparison, easier payment methods and more reliability.

Confidence in public charging is a key facet and this helps provide a cultural appreciation for electric vehicles while dispelling myths that it isn’t possible to charge in the public domain. And in more recent November 2023 news, the BBC reported that there will be more support and investment to encourage electric vehicle and battery companies to enter the UK The “Automotive Transportation Fund” which has already assisted Nissan and Tata, will be used to lure others to UK shores. Onsite lithium-ion battery production, as well as vehicle production, is key to reducing the expenditure and therefore the cost price of BEVs for the UK’s leasing customers.

The progression is welcome news for many businesses and SMEs who are quickly converting to zero-emission options. While moving to EVs is clearly beneficial for the company (Employer) with 100% allowance on any contract hire rentals, or 100% 1st year allowances for any purchase / Lease Purchase / Contract Purchase, the impact on the driver (Employee) has been an interesting one.

So why are company car drivers turning to electric cars - how do they impact the tax an employee pays? What is probably worth being clear on is that using a car that your employer provides is not a “free” situation. While the company may pay for the vehicle, the maintenance, the insurance and any ongoing costs, this doesn’t mean that there isn’t an impact on your personal tax.

As set out by HMRC you will have to pay tax if you use a vehicle for private use, including any commuting. The amount of tax you pay on the vehicle will be dependent on your situation and a company car and car fuel benefit calculator needs to be completed by your employer / HR. Key aspects will be included on the calculation including:

- The P11d, or vehicle value, being the list price including any options VAT but excluding FRF and VED;

- Benefit In Kind (BiK), which is a percentage applied to the list price. The actual percentage is defined by the emissions of the vehicle; and

- The employee’s income tax bracket, which will range from 0% (personal allowance), 20% (basic rate), 40% (higher rate) to 45% (additional rate).

The general rule is that the more expensive and polluting a vehicle is, the higher the company car tax bill will be. But with electric cars, which emit 0 g/km of CO2, the crucial point to note is that their BiK is currently 2% for tax year 2023-2024.

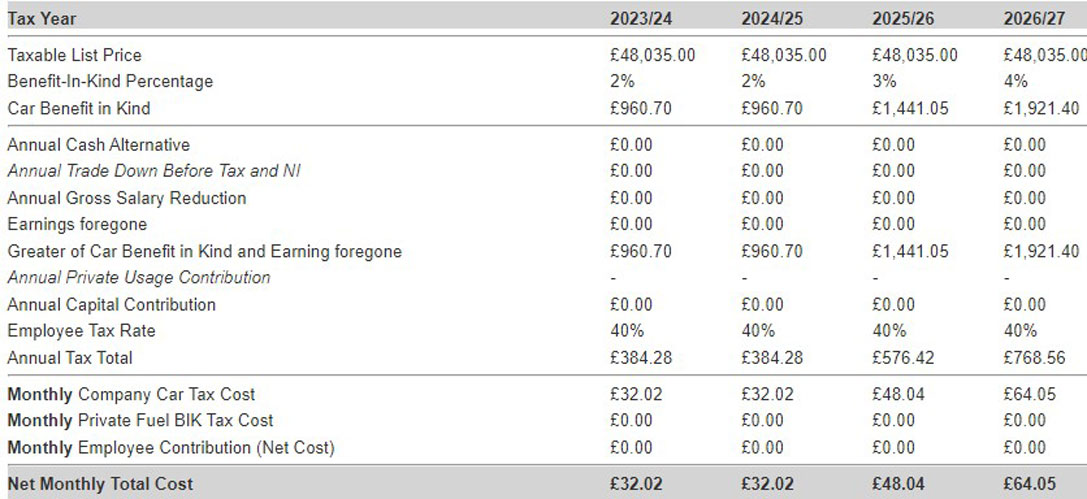

So while this may not necessarily mean much when said in isolation, the significance of this can be understood in the example below. For a Tesla Model 3 Saloon Long Range RWD Auto with Black Solid Paint (chargeable option), a UK taxpayer with a Higher Rate would pay around £32 per month in company car tax. See a more detailed example below:

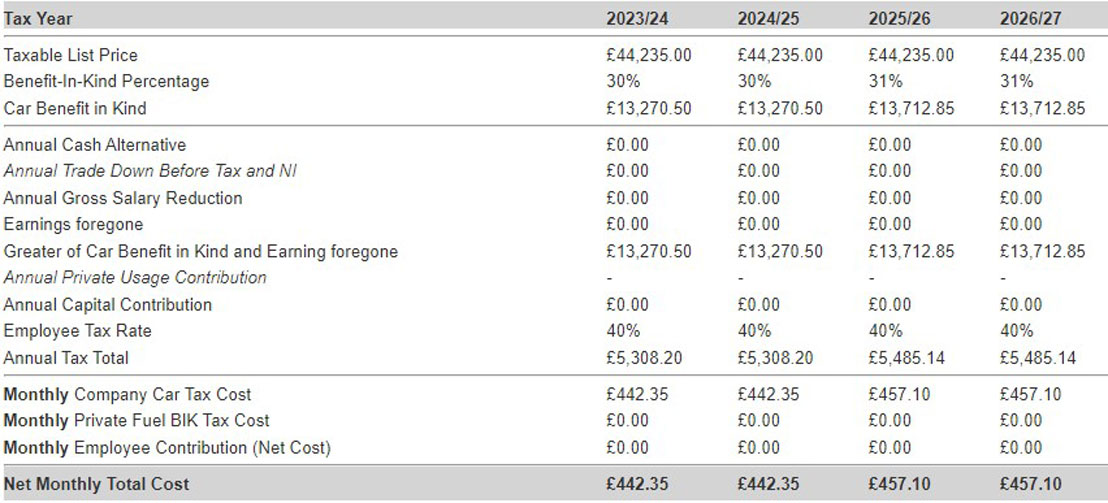

In comparison, a BMW 320d MHT M Sport 4dr Step Auto with metallic paint (chargeable option), would cost a UK taxpayer with a Higher Rate around £442 per month in company car tax.

When you compare these like for like examples, this is a good illustration on what a company car driver can effectively save when choosing an electric car - in this case it would equate to £400 per month! And while some drivers may be converting to PHEV (plug-in hybrid technology), with BiK for most options at around 15-18%, these do not offer the same tax savings nor do the cars offer comparable running costs for the company.

While the level of tax is bespoke to the driver, it is always worth mentioning the impact on the company too which can enjoy lower running costs associated with Class 1A NIC, fuel savings (electricity v petrol) and lower servicing / maintenance costs.

The Upcoming 2024 Electric Peugeot 3008 SUV - A brief guide to the next Stellantis favourite

So will cars like the new fastback SUV e-3008 be on your wish-list? So far, the Stellantis-owned Peugeot will be launching two specifications for 2024 launch including:

- 157kW Allure 73kWh 5dr Auto - this will include 19” black diamond alloy wheels, HD reversing camera, Peugeot Open and Go plus dark tinted windows, LED headlights, rain sensors, welcome lighting, lane keep assist, navigation, rear parking sensor, wireless smartphone charger, climate control and 2 keys; and

- 157kW GT 73kWh 5dr Auto - this will include 20” alloys, Pixel LED headlights, 9-colour ambient lighting, hands-free electric tailgate, black diamond roof, alcantara interior, front parking sensors, heated seats and heated steering wheel.

How does the electric Peugeot 3008 perform?

This FWD Fastback will have a 73 kWh usable battery which will offer 0 – 62 times of 7.0 seconds, 112 mph top speeds and 157 kW (or 211hp). Expect a combined winter range of 210 miles with warmer weather allowing for 285 miles.

On charging, the 11 kW AC max will allow 8 hour 0 – 100% charging times with the 160 kW DC maximum allowing 36 minute 10 – 80% times. A cargo volume of 520L is available with this car. It has a vehicle fuel equivalent of 139mpg. This EV will have Bidirectional charging with a Type 2 exterior outlet capable of 3.6 kW AC. There is no information on towing.

e-car lease work alongside these select finance companies:

e-car lease have a partnership and affiliation with:

Register & get new deals weekly

Exclusive offers

Exclusive offers

Electric-only deals

Electric-only deals

Never miss out

Never miss out

Talk to one of our experts

01942 910 001 Email usLeasing

© Copyright 2025 e-car lease. All rights reserved. e-car lease is a trading name of CarLease (UK) Ltd, e-car lease is a credit broker and not a lender. We are authorised and regulated by the Financial Conduct Authority. Registered No: 706617. BVRLA Membership No. 1471. Registered in England & Wales with Company Number: 09312506 | Data Protection No: ZA088399 | VAT No: 200422089 | Registered Office: Kings Business Centre, Warrington Road, Leigh, Greater Manchester, WN7 3XG

Made by morphsites®