Mon-Fri 9am-5pm

Talk to our friendly electric car leasing experts now: 01942 910 001This website uses cookies to ensure you get the best experience. Learn more

How will the Autumn Budget impact Electric Vehicles

The Autumn Budget, how will this impact Electric Vehicles?

It’s fairly obvious that the UK’s Government has undergone some significant turmoil in the last few months; PM changes, cabinet member exits, inflation and interest rates plus an alleged energy crisis. The media have been busy reporting much of the big news to us with an overarching theme that we should be concerned with the changed political and economic circumstances.

So for many of us in the UK automotive industry we were curious, if not a little concerned, as to what the Chancellor would deliver in the Autumn statement . In particular, for EV experts like e-car lease, we do rely on strong political support and messages as part of our campaign to help individuals and business transition from combustion engines (petrol and diesel) to pure electric options (lithium-ion batteries).

So - what did the Autumn 2022 statement do for electric vehicles?

Company Car Tax - “Company car tax rates will remain lower for electric vehicles and I have listened to industry bodies and will limit rate increases to 1 percentage point a year for three years from 2025.”

For any company car or salary sacrifice customer, they will be aware that HMRC will impose taxation on the individual driver as part of this arrangement - When an employer provides a vehicle to an employee, the car and the fuel must be accurately recorded to HMRC so they can apply the requisite level of tax.

The way that this is calculated is to take the value of the vehicle (the P11d) which is effectively the list price of a vehicle (including Vat) and any options and delivery charges but excluding the FRF and VED (and this does not include any discounts either). The more expensive your vehicle, the higher the level of tax you will pay.

![BMW I4 GRAN COUPE 250kW eDrive40 M Sport 83.9kWh 5dr Auto [Pro Pack] Electric Car Leasing](/userfiles/ckfinder/images/BMW-I4-GRAN-COUPE-250kW-eDrive40-M-Sport-83-110%25-compressed.jpg)

To calculate your company car tax the P11d will be multiplied by a percentage which is set according to the CO2, or emissions, of the vehicle. Because an electric car emits zero tailpipe emissions, this is referred to as 0g/km.

As a result of the favourable emissions, the Benefit-in-Kind (or BiK) which has been applied to EVs has so far been 1% for 2021-2022, 2% for 2022-2025 and, now based on the Chancellor’s confirmations, this will increase at 1% every year. To be clear, this means 2025/26 will be 3% and 2026/27 will be 4%.

The reality for business cars and sal sac is that a favourable position will still apply and the financial reasons for moving into all-electric options are still apparent. While this only benefits a specific segment of the UK society, the fleet industry is incredibly important, in particular for providing quality 2nd hand options for years to come i.e. retail and consumer markets.

The future of new EVs, and their corresponding residual values, is heavily reliant on the used car industry. At e-car lease, we are thrilled to see the ongoing support and certainty for our business / fleet customers, having joined the #SeeTheBenefit campaign from the BVRLA earlier this year. For more information, see our company car tax calculator on every deal on the e-car website.

Vehicle Excise Duty - “And, because the OBR forecasts half of all new vehicles will be electric by 2025…to make our motoring tax system fairer I have decided that from April 2025 electric vehicles will no longer be exempt from Vehicle Excise Duty.”

For any new vehicles which are registered in the UK you must pay a fee, which is known as the First Registration Fee (FRF). In addition, you must have a Vehicle Excise Duty (VED) payment configured within your deal, whether this be purchase, lease or similar.

From April 2021, a higher threshold has been placed on manufacturers via the Real Driving Emission 2 (RDE2) standards, which places higher rates on diesel vehicles. For an electric car, which emits 0 g/km, there has been no cost in terms of VED, as they have been exempt.

To compare, a car emitting over 255 g/km which does not meet the RDE2 standard would pay a whopping £2,245 and, should that vehicle have a list price of £40,000 or more, an additional £335 per year is payable (although electric vehicles are exempt from the surcharge from April 2020).

However, the Chancellor has confirmed that the position will be adjusted for EVs as they continue to grow in demand. From April 2025, any EVs registered from 1 April 2017 will pay VED at the same rate of low emission petrol and diesel vehicles, which is £10 for the first year and a flat rate thereafter (which is currently £165 per year).

In addition, the surcharge, or Expensive Car Supplement, will end in 2025 and for those with a list price of £40,000 or higher, they will pay the £355 supplement. While the change in VED for BEVs was expected, the only counter is that more punitive measures should be applied to more polluting combustion models, to highlight the cost benefit of moving into the electric world.

And for those drivers able to afford a £40,000 EV, which does include quite a lot of them, the incremental increase via the Expensive Car Supplement should provide additional revenue for the Government to invest into other key elements like charging infrastructure and electricity prices / energy support.

Will this derail the growth of EV's? Or will the UK continue to lease and buy with continued enthusiasm?

Other points - In addition, the First Year Allowance for a chargepoint will remain in place until 2025, so that businesses can offset their charging infrastructure against corporation tax and grow a charging network. The advisory fuel rates, which is how company car users claim for fuel, will also change to allow EV drivers to claim for 8 pence per mile, instead of the 5 pence per mile. With rising electric city costs, particularly for rapid charge facilities on the public network and service stations, this is welcome news.

In summary, there has been nothing more than nominal changes to our tax position and for EVs, they will still only incur smaller adjustments which should not in any way derail their continuing popularity nor penalise a PCH, BCH or Sal Sac customer for utilising one. The future of EVs continues to look a bright one.

In terms of the car shown, the BMW I4 GRAN COUPE 250kW eDrive40 M Sport 83.9kWh 5dr Auto [Pro Pack], this is based on the following configuration:

- M Brooklyn Grey Metallic Paint

- Vernasca leather - Black with grey stitching

- Aluminium rhombicle anthracite interior trim

- Mode 3 charging cable

- Flexible charger

What is the range of the BMW i4 40 M Sport?

.jpg)

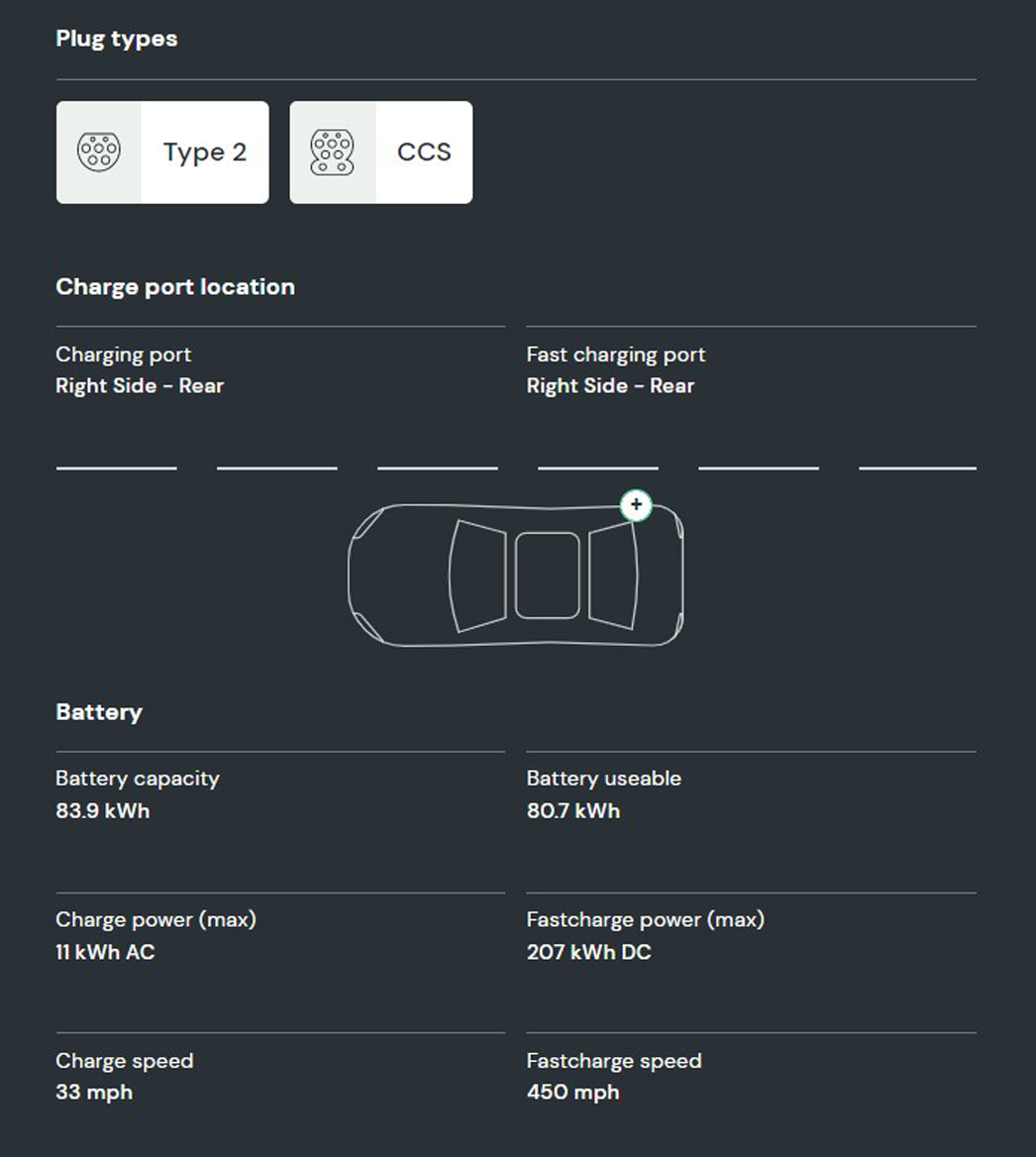

What is the battery capacity and charging speed on the BMW i4 40 M Sport?

How long does it take to charge the BMW i4 40 M Sport?

.jpg)

Where can I charge the BMW i4 40 M Sport

.jpg)

What is the company car tax on the BMW i4 40 M Sport

.jpg)

e-car lease work alongside these select finance companies:

e-car lease have a partnership and affiliation with:

Register & get new deals weekly

Exclusive offers

Exclusive offers

Electric-only deals

Electric-only deals

Never miss out

Never miss out

Talk to one of our experts

01942 910 001 Email usLeasing

© Copyright 2025 e-car lease. All rights reserved. e-car lease is a trading name of CarLease (UK) Ltd, e-car lease is a credit broker and not a lender. We are authorised and regulated by the Financial Conduct Authority. Registered No: 706617. BVRLA Membership No. 1471. Registered in England & Wales with Company Number: 09312506 | Data Protection No: ZA088399 | VAT No: 200422089 | Registered Office: Kings Business Centre, Warrington Road, Leigh, Greater Manchester, WN7 3XG

Made by morphsites®