Mon-Fri 9am-5pm

Talk to our friendly electric car leasing experts now: 01942 910 001This website uses cookies to ensure you get the best experience. Learn more

Your Definitive Guide to the VW ID7 Electric Car Lease

The VW ID7 Electric Car Lease - Your Definitive Guide

The push to EVs is about to get some fantastic news for 2025. The Labour Government, under the watchful eye of the Chancellor Rachel Reeves, are purporting to be pushing forward with a new interest free / loan subsidy scheme to help consumers access EV solutions .

As reported in the FT there have been discussions between the political powers and automotive finance companies to help bring acquisition costs of battery technology more in-line with petrol and diesel solutions. In the used-car sector particularly, where residual values and buyer / seller confidence has been frail at times, there is almost certainly a need for the Government to support uptake.

This is even more important in 2025, as we move to a 28% threshold requirement for zero-emission vehicles under the ZEV Mandate. For strong and competitive new car deals in the personal and fleet markets, the 2nd hand and used market must be robust.

In the absence of any grants for the EV, or the charge point if you own your home, there needs to be underlying assistance from our politicians. With a swathe of exciting new cars emerging, with incredible ranges, charging capabilities and aesthetics, there needs to be a mature platform ready to move these ex-fleet options into UK customers.

While our recent used-electric car leasing deals section is one such route many in the UK still prefer ownership routes. Finance options like Hire Purchase and Contract Purchase therefore need the backing of the Government, to ensure customers are offered a competitive and fair deal for their commitment.

In the new car segment, the UK Government has already thrown considerable weight and support behind the uptake in the business fleet and salary sacrifice aspect. For limited companies, especially those in heating, ventilation, and air conditioning, utilising company money as tax efficiently as possible is high on the agenda.

For any directors or employees seeking to procure a car, the question is always centred around getting the best car for the cheapest amount! With company car schemes, it isn’t just the cost of the monthly rental which is pertinent; we need to consider corporation tax, VAT and income tax.

With an EV, because it emits no tailpipe emissions (0g/km), the HVAC limited company can reclaim 100% of the monthly rental against corporation tax. If you decide to purchase the car instead, then 100% of the vehicle can be reclaimed in the first allowance (this includes cash purchases, hire purchase and contract purchase).

For highly profitable enterprises this is an exceptional and often misunderstood benefit. If you own a HVAC Ltd company, why would you use dividends or your PAYE to buy or lease a car? From a tax perspective this just doesn’t make sense.

For the employee, whether this be a director, manager or outbound sales, there are huge repercussions based on vehicle choice.

Using a company car, whether on fleet or sal sac, is not a “free” benefit. HMRC expect that a tax will be applied to the monthly salary based around the vehicle’s value (P11d), the emissions (shown as g/km) and the income tax bracket. In short, if you choose to use a more expensive and more polluting vehicle, you will pay an extraordinary amount of personal tax.

In contrast, since 2020 HMRC have supported those drivers using a BEV, as the level of BiK (Benefit in Kind) is much more nominal. These represent tax savings of hundreds of pounds per month on like for like comparisons. The National Insurance savings for the employer too must not be forgotten.

For any charge point investment by the company, this can be offset against corporation tax under the full expensing rules. As electricity is not considered a fuel, any charging on premises / company HQ is not going to create an income tax liability. When you consider all of this, there are some significant persuasions towards the all-electric vehicle.

New vehicles, like the VW ID.7, do add incredible weight to the EV transition. Available as a Fastback Saloon and a Tourer, the Passat equivalent has proved to be even more popular than we at e-car expected. It is the Tourer version which has really caught the attention for many leasing customers.

Much of this down to the lack of estate vehicles in what is really an SUV and 4x4 dominated industry. While many UK drivers do prefer the higher driving position and comfort the SUV presents, there are many families who require more practical and ergonomic solution. Although the Audi A6 e-tron and BMW i5 are great examples, their price tag can alienate much of the PCH and small BCH markets.

What specification of VW ID.7 are available?

At present there are three key options including:

- Pro Match - £51,580 as a saloon / £52,270 as a Tourer - this option includes 19” Hudson alloys, 15” navigation and infotainment screen, HUG with augmented reality, area view camera, rear view camera, keyless access, climate control (3-zone), massage seats, LED Matrix lights, climate windscreen, privacy glass, electric tailgate, privacy glass, exterior pack, power-adjustable lumbar support, heated front seats, welcome light, lane assist, dynamic road sign display and memory feature for park assist plus;

- Pro S Match - £55,480 as a saloon / £56,170 as a Tourer - this option includes all of the options above, but with the addition of a bigger and more comprehensive battery; and

- GTX 4Motion - £62,010 as a saloon / £62,700 as a Tourer, this specification adds Harmon Kardon sound system, adaptive chassis control, ventilated massage seats, heated rear seats, ports style bumpers, 20” Skagen black alloys.

Key colours include the Grenadilla Black, Moonstone Grey, Aquamarine Blue and Kings Red. In terms of options, add the energy efficient heat pump (for £1,150), exterior plus pack and darkening panoramic sunroof (£1,100) and the tow bar (£1,050).

But how does the VW ID.7 perform - is it a good EV?

- Pro - this RWD Saloon will have a 77 kWh usable battery which will offer 0 – 62 times of 6.5 seconds, 112 mph top speeds and 210 kW (or 282hp). Expect a combined winter range of 245 miles with warmer weather allowing for 340 miles – a 295 mile combined. On charging, the 11kW AC max will allow 8 hour and 15 min 0 – 100% charging times with the 190 kW DC maximum allowing 27 minute 10 – 80% times. A cargo volume of 532L is available with this car. It has a vehicle fuel equivalent of 155 mpg. You can tow 750kg (Unbraked) and 1000kg (Braked). It also has no V2L or V2G capabilities. The Heat Pump is optional;

- Pro S - this RWD Saloon will have a 86 kWh usable battery which will offer 0 – 62 times of 6.6 seconds, 112 mph top speeds and 210 kW (or 282hp). Expect a combined winter range of 270 miles with warmer weather allowing for 375 miles – a 325 mile combined. On charging, the 11kW AC max will allow 9 hour and 15 min 0 – 100% charging times with the 200 kW DC maximum allowing 27 minute 10 – 80% times. A cargo volume of 532L is available with this car. It has a vehicle fuel equivalent of 153 mpg. You can tow 750kg (Unbraked) and 1000kg (Braked). It also has no V2L or V2G capabilities. The Heat Pump is optional; and

- GTX this RWD Saloon will have a 86 kWh usable battery which will offer 0 – 62 times of 5.4 seconds, 112 mph top speeds and 250 kW (or 335hp). Expect a combined winter range of 250 miles with warmer weather allowing for 345 miles – a 300 mile combined. On charging, the 11kW AC max will allow 9 hour and 15 min 0 – 100% charging times with the 200 kW DC maximum allowing 27 minute 10 – 80% times. A cargo volume of 532L is available with this car. It has a vehicle fuel equivalent of 153 mpg. You can tow 750kg (Unbraked) and 1200kg (Braked). It also has no V2L or V2G capabilities. The Heat Pump is optional.

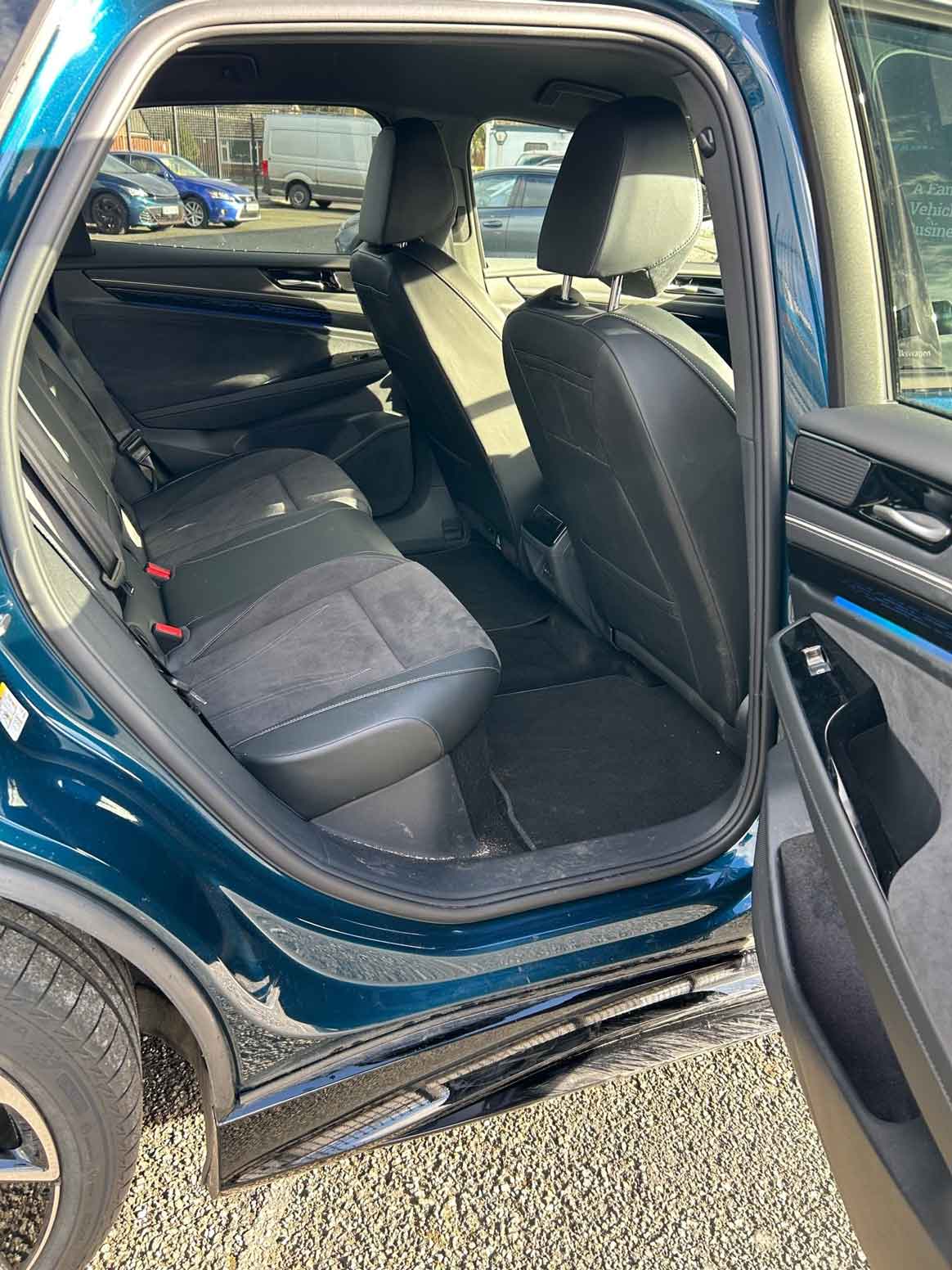

In terms of the car shown, the VOLKSWAGEN ID.7 HATCHBACK 210kW Match Pro 77kWh 5dr Auto Pure Electric Vehicle,

- Aquamarine blue Metallic Paint

- Art Velours eco microfleece cloth upholstery with seat bolsters in Artex - Soul black

- 19" Hudson black gloss turned surface alloy wheels with airstop tyres

Click for more information on our best VW ID.7 leasing deals or build your ideal specification on the VW manufacturer website. Alternatively get in touch with our team on 01942 910 001 or by emailing us at [email protected]

e-car lease work alongside these select finance companies:

e-car lease have a partnership and affiliation with:

Register & get new deals weekly

Exclusive offers

Exclusive offers

Electric-only deals

Electric-only deals

Never miss out

Never miss out

Talk to one of our experts

01942 910 001 Email usLeasing

© Copyright 2026 e-car lease. All rights reserved. e-car lease is a trading name of CarLease (UK) Ltd, e-car lease is a credit broker and not a lender. We are authorised and regulated by the Financial Conduct Authority. Registered No: 706617. BVRLA Membership No. 1471. Registered in England & Wales with Company Number: 09312506 | Data Protection No: ZA088399 | VAT No: 200422089 | Registered Office: Kings Business Centre, Warrington Road, Leigh, Greater Manchester, WN7 3XG

Made by morphsites®